OPEN NOW DIAMOND REWARDS QUALIFICATION CALENDAR

For all details, account definitions, features and fees, please refer to this account's

Truth In Savings Disclosure, our Personal Deposit Accounts Fee Schedule and Deposit Account Agreement & Disclosure.

|

Earn High Interest

|

Nationwide ATM Fee Refunds

|

Easily Waive the $10

|

|

Digital Banking

|

Debit Mastercard®

|

Smart ALAC™

|

|

MoneyPass®

|

Unlimited Check Writing No per check charge or monthly limits. |

Link to Diamond Rewards Saver

|

Diamond Rewards checking is consumer account that provides variable rates and variable rewards.

OPEN NOW DIAMOND REWARDS QUALIFICATION CALENDAR

Other Available Services

|

Consumer Credit Card We even offer a secured card if you need to establish or rebuild your credit. |

Mortgage Loans |

Personal Loans |

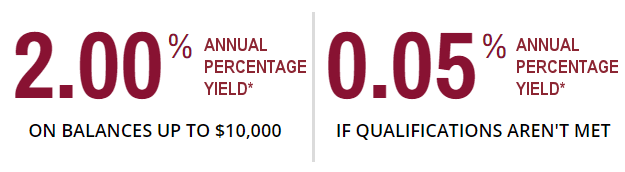

*Information, including Annual Percentage Yields, is accurate as of April 1, 2025. All accounts subject to approval. Restrictions and limitations may apply. Our personal checking accounts are general purpose consumer accounts. Such accounts are not to be used for commercial purposes. There are no fees to open or close this account. At any time and at the discretion of BAC Community Bank (BAC) standard features and account requirements may change after an account is opened. A customer may need to initiate the use of some services by enrolling in or requesting the service.

Other terms and conditions may apply. Refer to the specific account’s Truth In Savings Disclosure, our Personal Deposit Accounts Fee Schedule and our Deposit Account Agreement & Disclosure for additional information.

Minimum deposit to open Diamond Rewards checking is $100. Interest rates and rewards are variable. At any time and at the discretion of BAC rates, qualifications, and rewards may change after account is opened. Fees may reduce earnings. Annual Percentage Yield calculations are based on an assumed total account balance of $10,000 plus $100,000.

Sample Calculations: Sample calculations for rewards earned on Diamond Rewards checking are based on an assumed account balance of $10,000 + $100,000 and an assumed statement cycle of 31 days. Since any portion of an account balance over $10,000 earns a lower interest rate when qualifications are met, higher balance accounts may earn a lower compounded Annual Percentage Yield than the examples given.

Qualifications Information: Account transactions and activities may take one or more Business Days to post and settle to the account and all must do so during the Monthly Qualification Cycle in order to qualify for the account’s rewards. The following activities do not count toward earning account rewards: ATM-processed transactions, transfers between accounts, debit card purchases processed by merchants and received by BAC as ATM transactions and purchases made with any debit card issued by someone other than BAC.

Business Day means any day Monday through Friday, provided that the weekday is not on a federal holiday. When a federal holiday falls on a Sunday, the next Monday is not a Business Day.

Calendar Day means any day on a calendar including weekdays, weekends, and holidays. There are no exclusions.

Statement Cycle means the period of time for which BAC provides a summary of the financial activities and transactions that post and settle to the accountholder’s account. The Statement Cycle ends on the last Business Day of the month. The Statement Cycle begins on the first Calendar Day following the last business day of the month.

Monthly Qualification Cycle is a period of time used for determining rewards eligibility and the account's monthly service charge. This period ends one Business Day prior to the close of the current Statement Cycle with a new Monthly Qualification Cycle beginning the next Calendar Day. Please refer to our current Diamond Rewards Monthly Qualification Calendar available through any branch or our web site at www.bankbac.com/DiamondRewardsCalendar.

Automatic Qualifications and Bonuses: A new customer who opens a consumer deposit rewards checking account for the first time may receive the standard rewards (Diamond Rewards or Diamond Rewards Cashback) once without meeting any of the requirements during the initial Monthly Qualification Cycle. This feature is only available to new consumer deposit rewards checking accountholders one time, one pay out, and will not be honored for accounts that convert between deposit products. The automatic qualifications and/or bonuses feature may be discontinued by BAC at any time.

Reward Information: When your Diamond Rewards checking account qualifications are met during a Monthly Qualification Cycle,

Rewards and ATM fee reimbursements will be credited to the appropriate consumer deposit rewards account on the last day of the current Statement Cycle.

When Diamond Rewards checking account qualifications are not met,

When Diamond Rewards checking account is linked to a Diamond Rewards Saver account: When linked to a Diamond Rewards Saver account, the interest earned within the Diamond Rewards checking account does not compound since it is automatically transferred to the Diamond Rewards Saver account the day after being credited to your Diamond Rewards checking account. Consequently, when linked to Diamond Rewards Saver, and your Diamond Rewards checking account qualifications are met, balances up to $10,000 in your Diamond Rewards checking account receive a non-compounding Annual Percentage Yield of 1.98% (based on an interest rate of 1.98%); and balances over $10,000 earn 0.25% interest rate on the portion of the balance over $10,000, resulting in a non-compounding range from 1.98% to 0.25% Annual Percentage Yield depending on the account’s balance. The Diamond Rewards Saver Annual Percentage Yields may be less than the Diamond Rewards checking account Annual Percentage Yields.

This automatic transfer may cause an overdraft to your Diamond Rewards checking account, if the respective account’s balance is less than the transferred amount when transfer occurs.

Balance Computation Method: We use the daily balance method to calculate the interest on your account. This method applies a periodic rate to the principal in the account each day for the period. The period we use is the Statement Cycle.

Additional Information: Account approval, conditions, qualifications, limits, timeframes, enrollments, log-ons and other requirements apply. Enrollment in electronic services (e.g. online banking, mobile banking, paperless statements) and log-ons are required to meet some of the account’s qualifications. Limit one consumer deposit rewards checking account per taxpayer identification number. A Diamond Rewards checking or Diamond Rewards Cashback account is required to have a Diamond Rewards Saver account. A linked Diamond Rewards Saver account is required for automatic savings. There are no fees to open or close a consumer deposit rewards account. See this account's Truth In Savings Disclosure and our Personal Deposit Accounts Fee Schedule for fees that may apply to this account. Contact a BAC service representative for additional information, details, restrictions, processing limitations and enrollment instructions.

†When linked to Diamond Rewards Saver, the interest in the Diamond Rewards checking account does not compound in the account since it is transferred into the Diamond Rewards Saver account. The Diamond Rewards Saver Annual Percentage Yields may be less than the Diamond Rewards checking account's Annual Percentage Yields.